reverse sales tax calculator texas

If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. For instance in Palm Springs California the total.

Property Tax Solutions For Texas Seniors

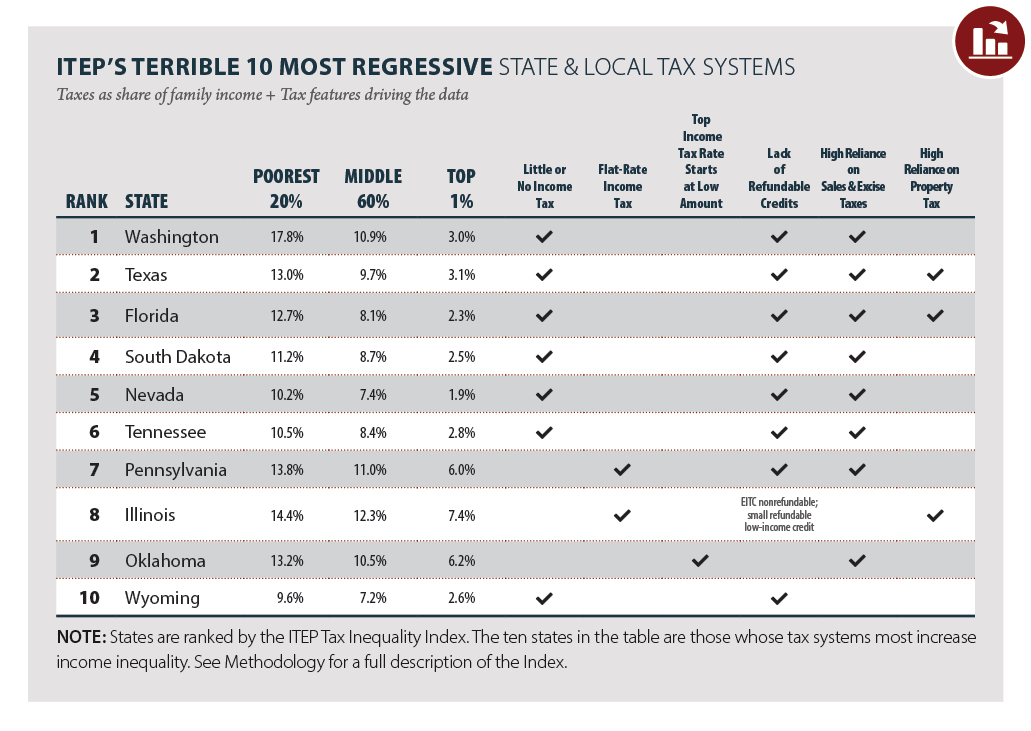

If the taxing unit either increases or decreases the sales tax rate from last year the taxing unit must perform an additional step to determine the.

. Enter the final price or amount. Before tax price in case of Reverse. Here is how the total is calculated before sales tax.

Maximum Possible Sales Tax. Average Local State Sales Tax. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as.

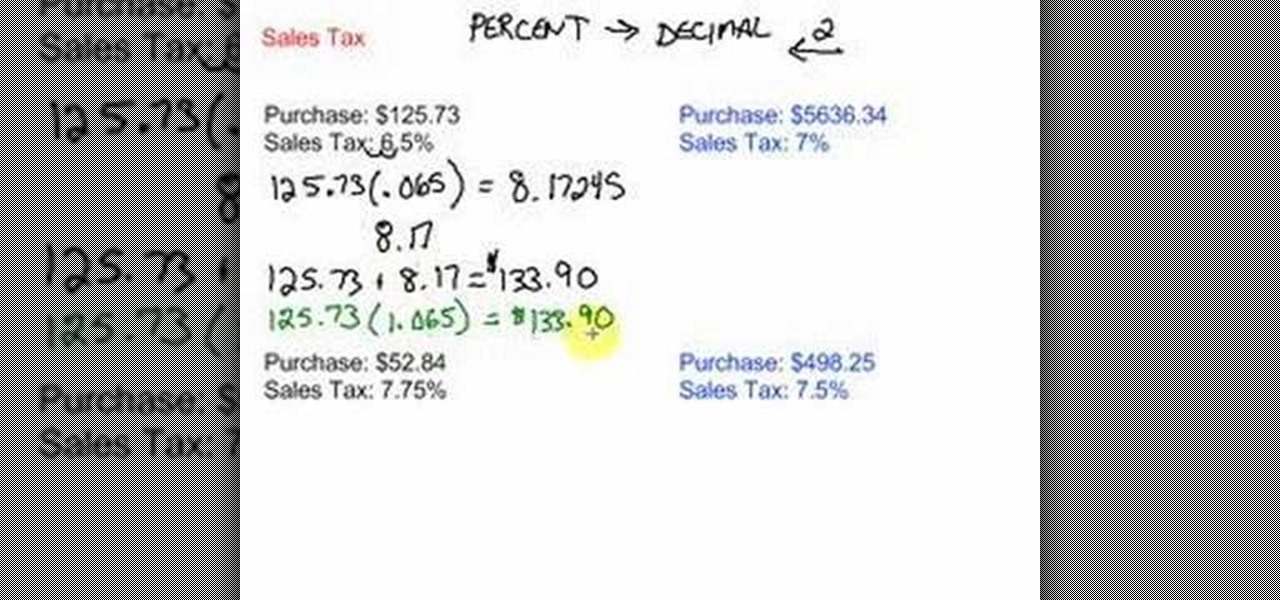

Maximum Possible Sales Tax. ST is the sales tax This can be useful for making sure you are being charged the correct amount out at stores and for understanding the total percent of the final price that. The formula to calculate the reverse sales tax is Selling price Pre-tax price final price Post-tax price 1 sales tax.

Divide your sales receipts by 1 plus the sales tax percentage. Enter the total amount that you wish to have calculated in order to determine tax on the sale. If you want to know how much an item costs without the Sales Tax you might want to.

This reverse sales tax calculator will calculate your pre-tax price or amount for you. Enter the sales tax percentage. Changing the Additional Sales Tax Rate.

Average Local State Sales Tax. You can calculate the reverse tax by dividing your tax receipt by 1 plus. The calculator will show you the total sales tax amount as well as the county city and.

On March 23 2017 the Saskatchewan PST as raised from 5 to 6. Often knowing the post-tax price in one municipality will provide little information of value to a person who is not subject to the same tax structures. Current HST GST and PST rates table of 2022.

Reverse Sales Tax Calculations. Amount without sales tax GST. The Sales Tax Calculator over here finds out the Tax imposed on various goods and services easily and makes your calculations quick and simple.

You will need to input the following. Sales Tax total value of sale x Sales Tax rate. Subtract that from the receipts to get your.

You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code. See the article. Here is the Sales Tax amount calculation formula.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Before-tax price sale tax rate and final or after-tax price. And all states differ in their.

Maximum Local Sales Tax. Tax rate for all canadian remain. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. Texas State Sales Tax. Multiply the result by the tax rate and you get the total sales-tax dollars.

Maximum Local Sales Tax. Formulas to Calculate Reverse Sales. This is the after-tax amount.

Texas State Sales Tax.

Us Sales Tax Calculator Reverse Sales Dremployee

How To Figure Out And Calculate Sales Tax Math Wonderhowto

Sales Tax Calculator And Rate Lookup Tool Avalara

How To Calculate California Sales Tax 11 Steps With Pictures

![]()

Sales Tax Recovery Reverse Sales Tax Audit Pmba

The Impact Of Hybrid Work On Commuters And Nyc Sales Tax Office Of The New York City Comptroller Brad Lander

1 125 Sales Tax Calculator Template

Reverse Sales Tax Calculator Calculator Academy

/https://static.texastribune.org/media/images/2015/08/19/31-Days-26-UnemploymentTax.jpg)

Employee Outsourcing Firms Get Tax Break The Texas Tribune

2022 2023 Tax Brackets Rates For Each Income Level

Stripe Launches Stripe Tax To Simplify Global Tax Compliance For Businesses

Easiest Capital Gains Tax Calculator 2022 2021

How To Crack Sales Tax Calculator With Reverse

7 6 Sales Tax Calculator Template

Car Tax By State Usa Manual Car Sales Tax Calculator

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price